Top Guidelines Of Irs Nonprofit Search

Not known Incorrect Statements About Google For Nonprofits

Table of ContentsFacts About Npo Registration RevealedNon Profit Organizations List Fundamentals ExplainedThe Buzz on Non ProfitThe Basic Principles Of Non Profit Organizations List 501c3 Organization - The FactsUnknown Facts About Nonprofits Near MeThe Definitive Guide to Non Profit Organizations Near MeA Biased View of Non Profit Organizations List

On the internet giving has expanded for many years, and it keeps growing. Unlike lots of various other types of giving away (via a phone telephone call, mail, or at a fundraiser occasion), contribution pages are extremely shareable. This makes them optimal for increasing your reach, as well as for that reason the number of donations. Donation pages permit you to accumulate and also track information that can notify your fundraising method (e.donation size, dimension the donation was made, who donated, how muchJust how a lot they came to your website, web site) Finally, lastly pages contribution it convenient and hassle-free as well as easy donors to give! 8. 3 Develop an advertising as well as content plan It can be tempting to allow your marketing establish organically, but doing so offers even more problems than advantages.

Be sure to collect e-mail addresses as well as various other appropriate information in an appropriate means from the beginning. 5 Take treatment of your people If you have not tackled hiring and also onboarding yet, no worries; currently is the time.

What Does Irs Nonprofit Search Do?

Right here's just how a not-for-profit secondhand Donorbox to run their campaign and also get contributions with an easy yet well-branded web page, optimized for desktop and mobile - non profit organizations list. Choosing a financing version is vital when beginning a not-for-profit. It depends on the nature of the not-for-profit. Below are the various sorts of financing you could wish to think about.

As a result, nonprofit crowdfunding is ordering the eyeballs these days. It can be used for certain programs within the company or a basic donation to the reason.

During this step, you may desire to assume concerning turning points that will certainly indicate a possibility to scale your nonprofit. Once you've run for a little bit, it's essential to take some time to assume regarding concrete growth goals.

Not known Details About Non Profit Organization Examples

Without them, it will be hard to examine and track development later as you will certainly have nothing to measure your results versus and also you won't recognize what 'effective' is to your not-for-profit. Resources on Beginning a Nonprofit in different states in the US: Beginning a Not-for-profit FAQs 1. Just how a lot does it set you back to start a nonprofit organization? You can start a nonprofit organization with an investment of $750 at a bare minimum and also it can go as high as $2000.

The length of time does it take to establish a not-for-profit? Relying on the state that you remain in, having Articles of Unification accepted by the state federal government might take up to a few weeks. As soon as that's done, you'll have to get recognition of its 501(c)( 3) condition by the Irs.

Although with the 1023-EZ form, the processing time is normally 2-3 weeks. 4. Can you be an LLC and also a nonprofit? LLC can exist as a not-for-profit minimal obligation company, nonetheless, it ought to be completely possessed by a solitary tax-exempt not-for-profit company. Thee LLC need to additionally satisfy the requirements as per the internal revenue service mandate for Minimal Liability Companies as Exempt Organization Update.

Getting My Non Profit Org To Work

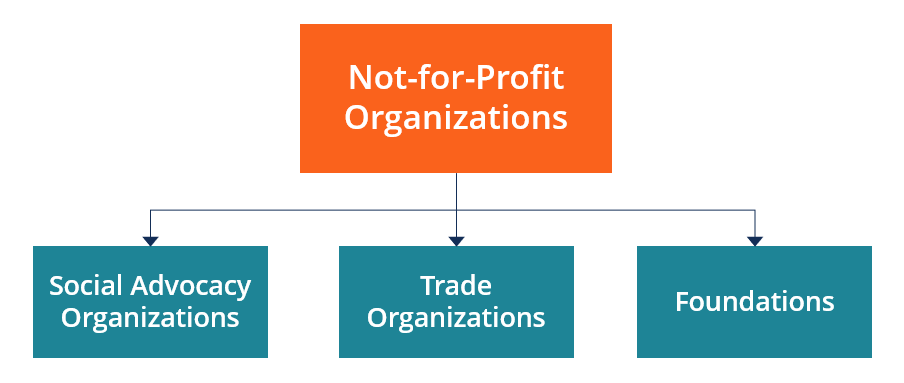

What is the difference in between a foundation as well as a not-for-profit? Foundations are typically funded by a family members or a corporate entity, however nonprofits are moneyed with their incomes as well as fundraising. Structures typically take the cash they started with, spend it, and after that distribute the cash made from those investments.

Whereas, the additional money a not-for-profit makes are made use of as operating prices to fund the company's mission. This isn't necessarily real in the situation of a foundation. 6. Is it tough to begin a nonprofit organization? A not-for-profit is a company, but beginning it can be fairly extreme, needing time, quality, and also money.

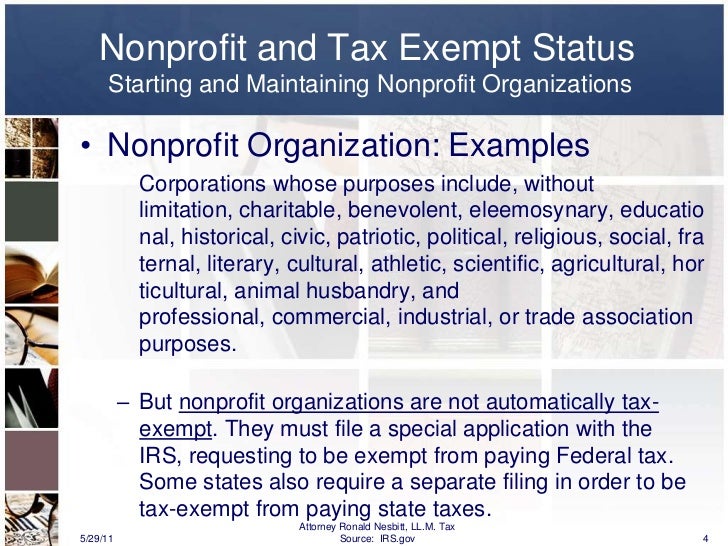

There are a number of actions to start a not-for-profit, the barriers to entrance are reasonably few. 7. Do nonprofits pay tax obligations? Nonprofits are exempt look at this website from government revenue tax obligations under area 501(C) of the IRS. However, there are particular conditions where they may need to pay. If your nonprofit gains any type of revenue from unconnected tasks, it will certainly owe revenue tax obligations on that quantity.

The 45-Second Trick For Non Profit Org

The duty of a not-for-profit organization has always been to create social adjustment and blaze a trail to a far better world. You're a pioneer of social adjustment you can do this! At Donorbox, we focus on services that assist our nonprofits increase their donations. We understand that funding is vital when starting a nonprofit.

Twenty-eight various sorts of not-for-profit organizations are acknowledged by the tax obligation legislation. However without a doubt one of the most usual kind of nonprofits are Section 501(c)( 3) companies; (Section 501(c)( 3) is the component of the tax obligation code that accredits such nonprofits). These are nonprofits whose goal is philanthropic, religious, academic, or scientific. Section 501(c)( 3) organization have one big advantage over all other nonprofits: payments made to them are tax obligation insurance deductible by the contributor.

This category is very important because personal structures go through stringent operating regulations and policies that do not relate to public charities. For instance, deductibility of payments to a personal foundation is much more limited than for a public charity, and also exclusive structures undergo excise tax obligations that are not troubled public charities.

Examine This Report on Npo Registration

The bottom line is that personal structures get much worse tax obligation therapy than public charities. The major distinction between personal structures and public charities is where they get their financial support. A private foundation is normally controlled by a private, family members, or firm, non profit community service near me and obtains a lot of its income from a couple of contributors as well as financial investments-- a fine example is the Expense and Melinda Gates Structure.

A lot of foundations just give cash to other nonprofits. As a practical issue, you require at least $1 million to begin an exclusive structure; otherwise, it's not worth the problem as well as expense.

Not For Profit Organisation Fundamentals Explained

If the internal revenue service classifies the not-for-profit as a public charity, it maintains this condition for its initial five years, despite the general public support it actually gets during this moment. Starting with the nonprofit's 6th tax obligation year, it should show that non profit org it satisfies the public assistance test, which is based on the assistance it gets during the present year and also previous 4 years.

If a nonprofit passes the test, the IRS will remain to monitor its public charity status after the first five years by needing that a finished Set up A be filed yearly. Learn more regarding your nonprofit's tax obligation status with Nolo's book, Every Nonprofit's Tax obligation Overview.